Welcome To Finance Function 4.0

Authors

Anders Liu-Lindberg

Anders is CMO and COO at Business Partnering Institute. He has 10 years of experience as a business partner and is a leading influencer and thought leader within finance, as well as an expert in practical execution and role modeling.

Michael Lykke Bülow

Michael is the founder and managing partner of Business Partnering Institute. He is an expert in working from the inside in organizations driving change and impact within finance. He has experience as a finance executive in large corporations and several years of management consulting experience from Deloitte.

Benita Ulrichs Nilsson

Benita is a partner and CFO at Business Partnering Institute. She has 15 years of experience in finance with hands on processes, advisory and leadership. She is also an expert in process optimization and change leadership in organizations.

Foreword

The finance function is on the brink of a complete transformation

The mass adoption of digital technologies such as automation and machine learning is now finally materializing. And with it comes a sea change in the way in which finance functions operate, and finance professionals spend their time.

Digital transformation is an extraordinary tool – one that can drive huge efficiencies in finance, just as it can in almost every other space. But the true potential of digital transformation is yet to be realized. For that to happen we need an evolution in mindset, and a new approach to the finance function and its uses.

In short, we need to reposition the finance function not as a cost center, but as a profit driver

Augmented by technology, existing finance functions are freed from the nuts-and-bolts work of technical accounting, the bulk of which can now be performed easily and efficiently by machines. This presents a huge opportunity for finance professionals. We can use this additional time to do things that software simply can’t: build relationships, think strategically, implement vision, translate data into actionable insight, and drive meaningful change within our organizations.

We call this new operating model the Finance

Function 4.0. In this publication, we explore the new landscape of modern finance.

• How is technology transforming our work?

• What does this mean for finance professionals

• What does it mean for the businesses in which

they operate?

• How can we position the finance function as

a driving force for strategic change?

Most importantly, I want to underscore the emerging role of the finance function: as a value-creator with the power not only to report and monitor, but to create real-world outcomes that benefit our businesses and their stakeholders.

I believe that this is the most significant period of change facing our profession in many years. I hope this publication can act as a roadmap for the Finance Function 4.0.

Welcome to the Finance Function 4.0.

Anders Liu-Lindberg

Introduction

Automation and the disruption it’s causing is having a profound impact on our world

Across every field of human endeavor, and particularly at every level of business, the efficiency and fault tolerance of machines is transforming the way we interact and make decisions. The finance function is one of the fields of business already being disrupted most acutely by these new technologies.

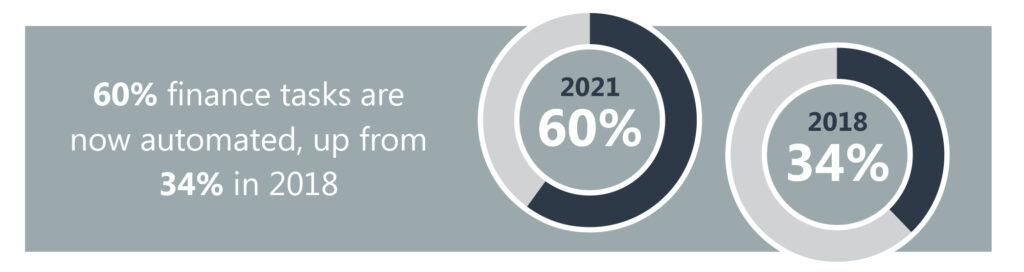

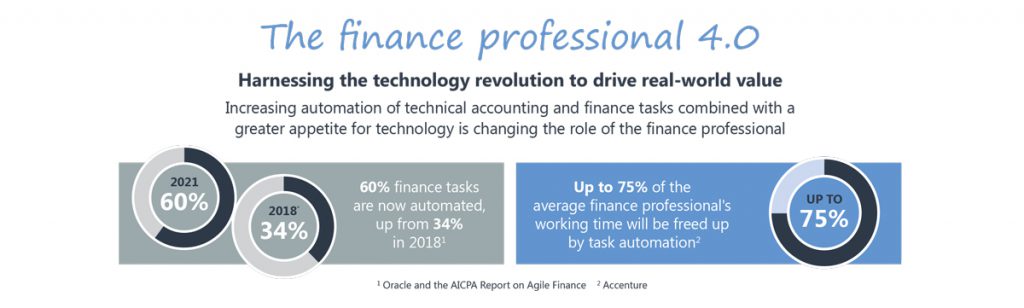

Some people see this as a threat – but this could not be further from the truth. Rather, automation presents a huge opportunity that cuts across every part of business and society: an opportunity for humans to move further up the value chain. The rise of automation, along with the explosion in the use of technologies such as APIs and other machine-readable instruction, has already changed not only finance but also fields like fintech. Witness, for example, the revolution that APIs have brought in the banking industry, giving rise to the ‘Banking-as-a-Service’ ecosystem and an entirely new suite of products, services and techniques. In finance specifically, the automation revolution has been long-discussed but is now finally beginning to bear fruit: Accenture’s 2021 CFO Now report found that 60% of finance tasks are now automated – a huge jump from the 34% recorded in 2018.

This trend is giving rise to major changes across the finance function and creating a new generation of finance professionals – individuals whose work is deeply entwined with technological advances, and whose day-to-day working lives are shifting in response to the growing influence of process automation. We call this the Finance Function 4.0.

What is the Finance Function 4.0?

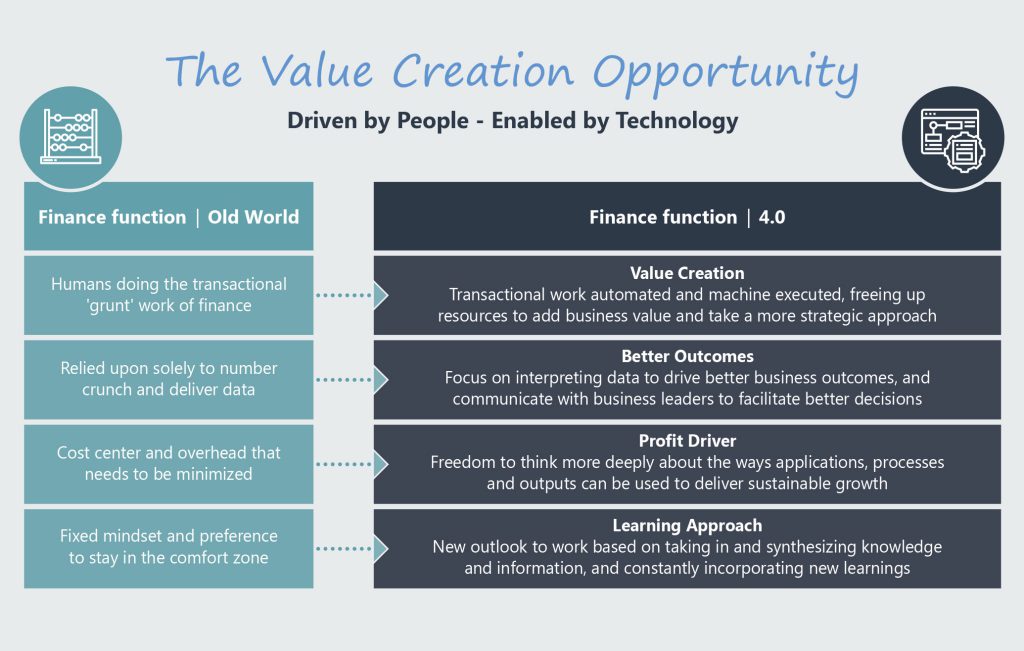

The end of the current paradigm in which humans are doing transactional work

People are freed up to do the things that machines cannot: the things that truly add value to a business and that enable finance professionals to maximize their input and influence on the organizations in which they work.

Finance professionals spend their time facilitating better decisions

The work of the finance function now focuses on conversations and the finance function takes on a more strategically important approach. Finance professionals are no longer relied upon solely to deliver data but instead to interpret it and to use their understanding of the numbers to drive better outcomes at every layer of the business.

Moving from cost center to profit driver

Technology has already delivered vast new efficiencies and has freed up resources that were otherwise dedicated to transactional work. As a result, finance professionals now have the freedom [and, indeed, the imperative] to think more deeply about the applications of the data they generate, and about the ways in which information can be used to deliver sustainable growth. Finance is now a driver of value creation. As finance professionals, our job is no longer ancillary but rather deeply embedded in the very foundations of business.

Humans make better systems

Businesses can automate all the processes they wish and, while this might deliver short-term efficiencies, it does not necessarily help us understand organizations better – for the time being at least, only humans can do this. In the Finance Function 4.0, the finance professional’s role becomes concerned with the development of processes that are not only fine-tuned for machine readability but that are also intuitive and simple to understand for the people making real-world decisions. Even when processes are automated, they must still be intelligible. What makes sense to a computer does not necessarily make sense to a business leader – and this problem is particularly acute in organizations that are already reliant on cumbersome legacy systems. Finance professionals now need to help management interpret and act on the information we receive from the systems and processes we have designed and established. Systems might run on their own, but they need real people with real expertise to make them useful.

Adopting A Learn Approach

As the finance function changes, so too must the mindset of finance professionals. Whether developing and fine-tuning processes, facilitating decision-making or interpreting data, the scope of work of the modern finance professional is morphing and expanding.

The most important characteristic for success is a learning approach. This is perhaps the most difficult part of the picture to pin down, but it is crucial.

Successful finance professionals will adopt an outlook on their work that is based on taking in and synthesizing knowledge and information, and constantly incorporating new learnings. There is an increasing overlap with knowledge management. Finance Function 4.0 professionals will take their cues not only from the established principles of the field, but also from new trends, tendencies, and movements across both finance and the wider business and management landscape.

‘Winning’ requires agility and quick movement – and that in turn relies on a learning approach and an open mindset. The question in finance, as in so many other aspects of our business lives, is no longer ‘is this possible?’, but rather, ‘how do we make this work for us?’.

We have already reached the inflection point at which technology revolutionizes the finance function. The new priority is to determine how we can harness these new technologies to drive real-world value.

What Does Finance Function 4.0 Mean For You As a Finance Professional?

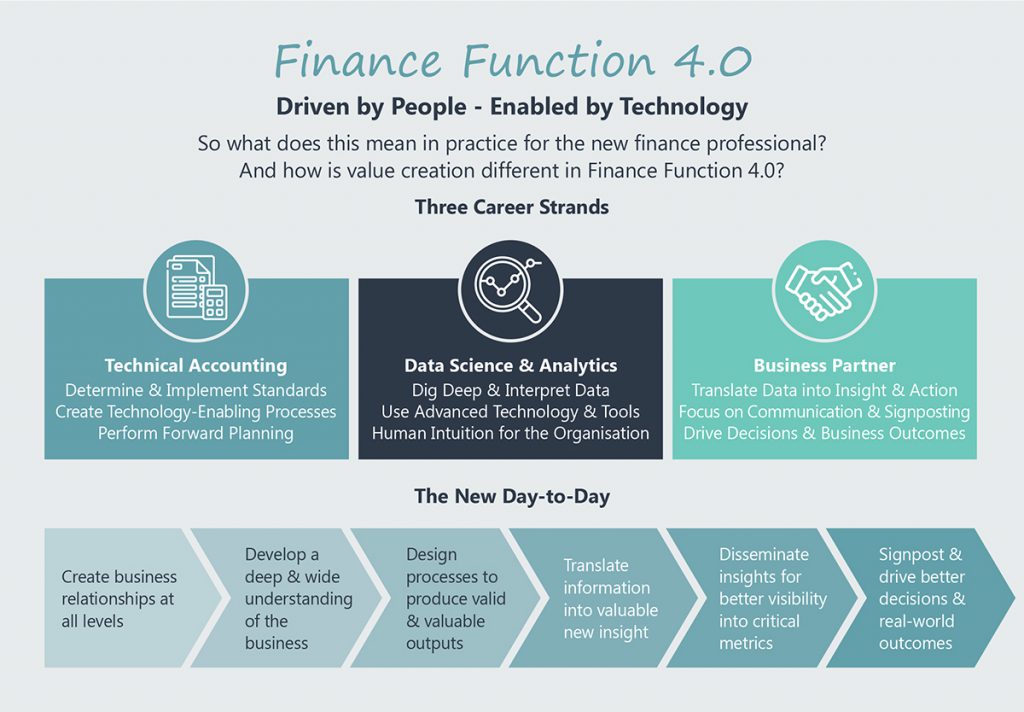

For professionals in Finance Function 4.0, there is one key principle: we must create value and take an active role in driving better outcomes throughout the organization. How is value creation different in the Finance Function 4.0?

The New Day-To-Day

The days of siloed working, with finance professionals cordoned off from other business functions, are over. It is also no longer enough for a finance professional to simply have top-drawer SQL or R skills. There is an increasing recognition that these are not the be-all and end all of finance work. Instead, they are tools that should be put to work in the service of broader value creation within an organization.

Modern finance professionals need comprehensive communication skills.

This new landscape is about relationships – about communicating the meaning and importance of the data that is being analyzed, and about signposting the ways in which it can be used to make better decisions throughout an organization

Professionals take on a more fundamental and more embedded role within their business.

In order to succeed in this paradigm professionals must have a holistic understanding of their organization, bridging gaps between data and action. Modern finance professionals need to think beyond the established boundaries of the finance function and focus not only on the inputs they are analyzing but also on the outcomes that can be produced through the application of that analysis.

In Finance Function 4.0, professionals don’t just find the gaps – they also drive the actions required to plug them.

It’s not just about providing information, but instead about turning that information into actionable insight and taking responsibility for the dissemination of that insight throughout an organization.

How Do We Know When The New Finance Function Is Performing Well?

Meeting or beating targets set by leaders in the organization will, of course, remain crucial. But measuring success is not only done through quantitative work – there is also an important new qualitative aspect.

Success in Finance Function 4.0 hinges on the depth and breadth of finance professionals’ contribution to their organization.

- How are you helping across the business?

- Are you providing not only information but also strategies and recommendations to ensure that the information is leveraged to produce better real-world outcomes?

- Are you going beyond simply reporting, and instead playing an active role in the development of the business?

In order to measure this impact, finance professionals need to consider new metrics, sometimes borrowed from other business functions. One way to gather qualitative feedback could be to use NPS measures based on feedback from business leaders. This ‘customer satisfaction’ scoring gives a firm handle on the real-world outcomes of our work and is a useful tool for all modern finance professionals.

This new landscape also requires finance professionals to adopt a different approach to career development. It is now important for professionals to document the value-add they have delivered within their organizations.

By demonstrating your creative and strategic input [and, crucially, the outcomes that were derived from them], and not only your technical proficiency, you will be well-placed for more rapid and fulfilling career progression.

How are you helping across the business?

Are you playing an active role in the development of the business?

Do you ensure that information is leveraged to produce better real-world outcomes?

How many decisions did you influence in the past week?

What profit was driven from those?

From Cost Center To Profit Driver

It’s time to stop thinking of the finance function as a cost center, and instead, recognize its importance as a profit driver. How many decisions did you influence in the past week, and what profit was driven from those?Career Paths In The Modern Finance Function

In the new paradigm, interpersonal skills, management nous and, above all, a focus on value creation are paramount. And this, of course, has implications for the career paths of finance professionals.What Are The Career Options In Finance Function 4.0?

There are three clear career strands that will not only persist in the Finance Function 4.0, but will, in fact, flourish.Technical accounting

This might seem counterintuitive, given what we’ve just heard about automation. But there remains a missing link between the creation of the standards by which we carry out our work, and the processes being developed to ensure we adhere to them. Computers can be instructed to perform virtually any imaginable technical accounting task, and we can tell them how to do that in a compliant way. But we still absolutely need people to determine and interpret the standards, and to create the processes that enable technology to do its work. And, of course, we need humans to carry out the forward-planning necessary to prepare for and implement new standards as they emerge.

Data science and analytics

Software is phenomenal at wrangling data, but all that work is useless without an understanding of what we’re looking for. We need people who can dig deep into the data, using the most advanced technology and tools, but with a human intuition for the organizations in which they are working.

Business partnering

The third career strand in the Finance Function 4.0 is emblematic of the future of finance. It is the transition from ‘pure’ finance to a business partner role. Here, finance knowledge and experience is only part of the story. Business partners use their understanding of the finance function to translate data into comprehensible, useful information. This role is about enabling better decision-making at every level of the organization, and about increasing the use-value of the work already being done within finance. Business partnering is about creating value by moving up the value chain, and it’s a key element of finance’s transition from a cost center to a profit driver.

How Do I Decide?

As the requirements placed on finance professionals are changing, so too are the personal traits that we might consider to be ‘best suited’ for the work. The accounting and finance workforce has traditionally been characterised as introverted and data-focused, while the finance function has tended to be siloed, as opposed to being interlinked within an organization. Clearly, both of those things are going to change.- Finance professionals will need to develop broader knowledge about the organizations in which they work, and an approach to work that is focused on interpersonal skills, cooperation, and knowledge-sharing.

- They will increasingly need to focus on value creation, and will spend most of their time interpreting information and translating it into better business decisions.

- Success will increasingly be measured according to real-world outcomes.

The Art Of The Possible

In fact, a recent report from Accenture found that 60% of traditional finance tasks are now automated – a significant rise from the 34% seen in 2018. This has brought major efficiency benefits, along with higher-quality data and reporting. But this is just the beginning. These technologies are in their comparative infancy and, more pertinently, many CFOs and other leaders remain under-informed about their applications and potential. The transition towards Finance Function 4.0 is gaining pace and we are just getting a hint of the long-term implications. The most important trend in finance will be the percolation of digital transformation knowledge throughout organizations. CFOs will take on a greater role in digital transformation at every level of business, and they will be required to gain a deep understanding of the new possibilities presented by tech. We will see the rise of ‘intelligent’ finance operations, with the application of advanced data science and machine learning driving even greater efficiency gains. We’ve already seen that some 60% of finance tasks are now automated; with the addition of OCR and the opening up of ML techniques to a broader range of participants, it’s likely that we can push that figure to around 80% in very short order.

Value Creation Is The Key

The real value of technology in the finance function is associated not only with cost savings, but also with value creation.

This is the most important element of digital transformation – it enables finance professionals to take on a more fundamental role within their organizations, focusing not just on technical accounting tasks but on contributing to strategic vision and enabling better decision-making that brings more profitable real-world outcomes.

According to Accenture, CFOs are already leveraging data and automation to drive real operational benefits. The efficient application of these technologies is yielding valuable new insight. Advances in the finance function are helping every layer of management to understand their organization more deeply, and providing better visibility of important but hitherto ignored markers and metrics.

These techniques are also being used to identify new value propositions for businesses, and to enable decision-makers to seize and respond to new opportunities. Just as importantly, the finance function is becoming more deeply involved in planning for future volatility and mitigating associated risks.

The application of new technologies is helping and encouraging finance professionals to transition into a new, more embedded role as “economic guardians” with fundamental responsibilities in strategy development and value creation.

Where Are The Limits?

Finance professionals might be concerned about the rapid automation of their field. Some estimates suggest that as much as 75% of the average finance department’s workload will be eliminated by automation.

Technology is already transforming the finance function but it has its limits. The organizations that succeed in the new tech-enabled paradigm will be those in which there is an understanding that technology is a tool but not a panacea. Efficient human-digital collaboration is the model of the future and it’s the approach that will shape finance in the coming decade.

In The Age Of Auomation, Finance Must Know Their Processes More Than Ever

If almost everything in the finance function can be automated, does it really matter how that work is carried out? What’s the role of process in the Finance Function 4.0 – and is it relevant at all?

Focus On Process

Technology is a double-edged sword. Its benefits are clear: the effective application of new technologies allows us to drive huge efficiency gains, and frees up humans to spend their time moving up the value chain and contributing more deeply and fundamentally to the future of their organizations.

But it does this in part through a process of occlusion, in other words, it has a tendency to present us with outputs while making the processes by which those outputs were generated much more difficult to understand.

The major risk is that our reliance on digital technologies comes with a ‘comprehension cost’. Organizations of every size survive based on the accuracy of the information they are working against. When that information is so fundamentally mission-critical, it is vital that we understand how it is arrived at, and how it is being produced.

This requires us to have a deep knowledge of the processes that are governing the technologies we are using – and, just as importantly, it requires finance professionals to focus their efforts on developing processes that produce outputs that are both valid and valuable for the organization in question.

If we don’t understand how our systems and processes are working, and if we don’t set the right rules by which they will operate, we are flying blind.

Technology Is A Tool, Not An Oracle

We are at a crucial inflection point for digital transformation, not only within finance but across countless areas of business and society. At this juncture, we have a choice. We can place all our trust in software, treating it as an oracle that delivers nuggets of absolute truth. Or, we can take the time to understand how the technology works and adopt a mindful approach to its use, ensuring that it is always being put in the service of strategic goals.

As technology advances ever more rapidly, the knowledge required in order to apply it usefully and reliably grows exponentially. Finance professionals, along with leaders in every part of an organization, must avoid the dangers of plugging in technological solutions that they don’t understand.

Digital transformation can radically improve real-world outcomes, but only if we understand how these new skills and techniques work – and their limits.

Cut Complexity

How can finance professionals ensure that they are leveraging technology to its greatest advantage, while still maintaining a comprehensive grasp on its workings?

Begin cutting out the complexity in your processes. Break those processes down to their core components, and make sure that there is a clear understanding of why your systems are doing what they are doing.

CFOs have a unique responsibility in this field, not only as the ‘economic guardians’ of their organizations but also increasingly as the people charged with making decisions about the technologies on which those organizations rely.

This requires a comprehensive understanding of those technologies, and a clear-eyed approach to their implementation.

Process might be less visible in the Finance Function 4.0, but it is no less important. Tech is revolutionising our work – but we need to understand the ‘how’ and the ‘why’, rather than placing our faith in tools that we do not fully grasp. Now try for yourself and map out your three most important processes. Can you and do you understand how they work and the role that technology plays in executing them?

Finance Transformation 4.0 – The Action Plan

The Action Plan

Regardless of the size of your organization, now is the time to begin the transformation process into Finance Function 4.0. Everyone in finance and beyond has a role to play in this transformation.

1

Technical accounting

Align on the mission to position finance as a driver of profit and value within every organization.

Agree on an operational vision which involves a combination of analysis and interpersonal partnership skills to make sure that all business decisions are driven by data – and always in consultation with finance. The Finance Function 4.0 has a crucial role to play in the translation of data into actionable insight. It’s not just a data ‘farm’ but rather a fully embedded support structure that allows organizations to take actions that lead to better real-world outcomes

2

Data science and analytics

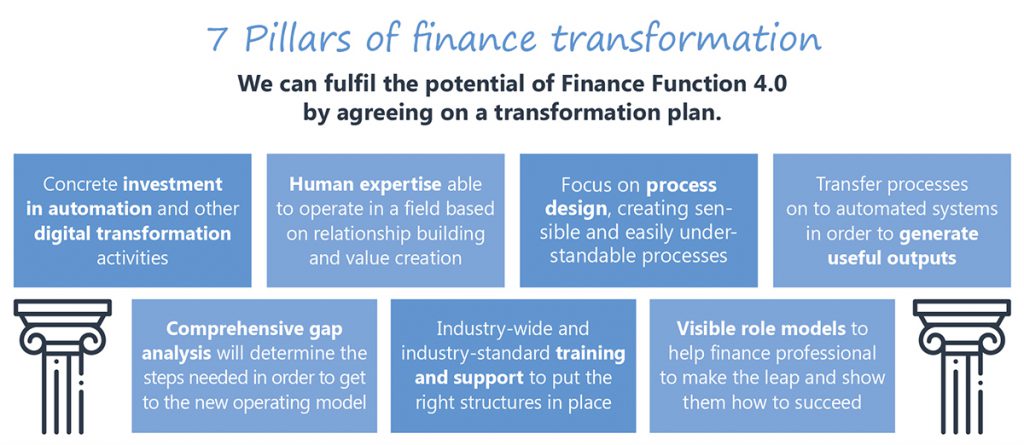

Agree on a transformation plan.

This will be seen on a microcosmic level within each organization and on a macro scale across the profession. Individual businesses need to understand the challenge and the opportunity but industry as a whole also needs to ensure that the support structures, training, and role models are available to help professionals make the leap.

Key elements:

- Concrete investment in automation and other digital transformation activities, delivered in tandem with human expertise. Humans still have a key role in an automated finance function, and part of this should focus on process design. • Create sensible, easily understandable processes that can be passed on to automated systems in order to generate useful outputs.

- Conduct a comprehensive gap analysis, performed by finance and leaders from across the organization in question to help managers work out how far away they are from the proposed new operating model and the steps they need to take in order to get there.

- Don’t underestimate the importance of training and role models. Professionals in the Finance Function 4.0 are expected to take on work and responsibilities that might be outside their normal wheelhouse. We need industry-wide and industry-standard training and support to help them meet those challenges.

With the right structures in place, and with visible role models showing early-career finance professionals how they can succeed, we will have taken a major step towards the establishment of the Finance Function 4.0.

OUR SPONSOR

Get better insight. Drive better decisions.

Jedox makes planning and Enterprise Performance Management seamless, in every organization, on any device, wherever the data resides. Our solutions provide reliable data, insights, and guidance to all users. Jedox delivers it all: Self-service budgeting, unified planning, and forecasting. Over 2,500 organizations in 140 countries trust Jedox to boost their performance, streamline business collaboration, and make insight-based decisions with confidence. Jedox boasts over 250 certified business partners internationally. Its ease-of-use and flexibility have earned Jedox high recommendation rates and recognition as a leader in its field by independent analysts worldwide.

“We replaced Excel with integrated planning and reporting through Jedox in a few weeks. Our specialist departments plan independently on the web. My team is able to focus on profitable growth.”

Michael Bailey, Senior Manager, Controlling, Sanofi

“Generally speaking, our business is growing. We intend to go even further with Jedox.”

Thomas Mosimann, CFO, McDonald’s Switzerland

“Jedox Cloud enables us to handle the increasing complexity of planning, reporting, and analysis.”

Philipp Rosenthal, Senior Manager FP&A, PPRO

We create value together by changing your finance function

We work from the inside with you creating impact that lasts. We are passionate people and how to drive mindset and behavioural change. We are finance people that believe in simple and practical solutions.

Research and Networks

We cannot succeed with business partnering alone but must bring together individuals, organizations, and communities to tell stories from the front and share best practices. This is how we create value together! We publish new viewpoints weekly and gather the largest communities in business partnering globally.

Learning and Development

To enhance your impact as a business partner, you must develop new capabilities and a new way of working. It sounds simple but can be difficult to do in practice. Business partnering should considered a change project and a learning journey. We take your team on a learning journey to elevate their influence in your company through business partnering.

Consulting

Too many consulting projects fail because they are not grounded in your company. We do this differently. Working alongside you, we create simple and pragmatic solutions that work and can be implemented. We call this inside-out consulting. We help you drive your business partnering transformation successfully and create results that matter.

“The finance organization across Danfoss has worked with the Business Partnering Institute to develop a group of highly skilled finance people. I can highly recommend this approach, that for sure has raised my expectations on what a finance business partner can and should be driving in the company.”

Thomas Auerbach, VP Finance at Danfoss

“It was the best and most effective use of a consultant that I have experienced – combining deep finance expertise with change management and communication skills. The solution was of high quality, pragmatic and tailored to our needs”

SVP at Global Retailer